Transitioning to Shared Value

Businesses continue to leave growth opportunities on the table with their current, dated approaches to corporate growth. When business leaders accept that the nature of the global economy has irreversibly changed and broaden their view of success, a new world of growth, opportunity, and shared value can emerge.

When we review the assumptions of modern-day growth strategies, we see their origins in a very different industrial era. These assumptions were crude and simple: few humans, many resources, forever-increasing demand curve, zero-sum winning or losing.

Faced with the challenges of our new normal, these approaches are falling flat. The nature of the global economy has transformed to an extent that early industrialists wouldn’t recognize it’s digital, fast, corporately-led, and increasingly global. We also transact in a new currency: data.

Thus, our new economy shakes these assumptions to their very core and exposes their weaknesses. The old mindset of “growth at any cost” has become too costly for businesses, employees, communities, business ecosystems, and the planet. We see the magnitude of negative externalities intensify annually, whether it be the degradation of oceans, forests, and air quality or the depletion of critical resources. The long-term impacts of the global pandemic have only intensified the need for a new approach to corporate strategy.

Even the most stoic pillars of the old economy, the fossil-fuel companies, are feeling the burn. Last July, two of the world’s largest energy companies signaled that the coronavirus pandemic may accelerate a global transition away from oil, resulting in billions of dollars in stranded assets. More specifically, Royal Dutch Shell said it would slash the value of its oil and gas assets by up to $22B USD amid a crash in oil prices. The announcement came two weeks after a similar declaration by BP, saying it would reduce the value of its assets by up to $17.5B USD.[1]

Both companies said the accounting moves were a response to not only the coronavirus-driven recession but also to global efforts to tackle climate change.

Some of the largest and most profitable companies in the world recognize the need to pivot. In 2017, the International Business Council (IBC) of the World Economic Forum (WEF), which is composed of 140 companies, has issued a “Compact for Responsive and Responsible Leadership.” In this compact, business leaders recognize that “society is best served by corporations that have aligned their goals to the long-term goals of society” and has identified the UN Sustainable Development Goals (SDGs) as the roadmap for that alignment. The IBC is working through the practicalities and challenges of balancing the short-term and long-term business pressures to ensure that shareholders and other stakeholders can prosper together.

Thus, the IBC has proposed a common, core set of metrics and recommended disclosures to align members’ mainstream reporting. In doing so, this is advancing a systemic framework that wouldn’t dissuade unfair or unequal competition amongst some of the world’s largest companies. Participating companies include Bank of America, IBM, Qualcomm, Chevron, Reuters, The Carlyle Group, and Unilever.[2]

Additionally, we see evidence of greater momentum with Business Roundtable’s statement of August 2019, which was a new statement on the purpose of corporation signed by 181 CEOs who commit to lead their companies for the benefit of all stakeholders customers, employees, suppliers, communities, and shareholders.

It is this transition that we are hoping to help elucidate and provide an actionable framework to help achieve this necessary transition.

From political, business, and civic leaders, we see corporations being challenged to think well beyond their purpose of delivering profits to shareholders exclusively. Thus, a new model is needed.

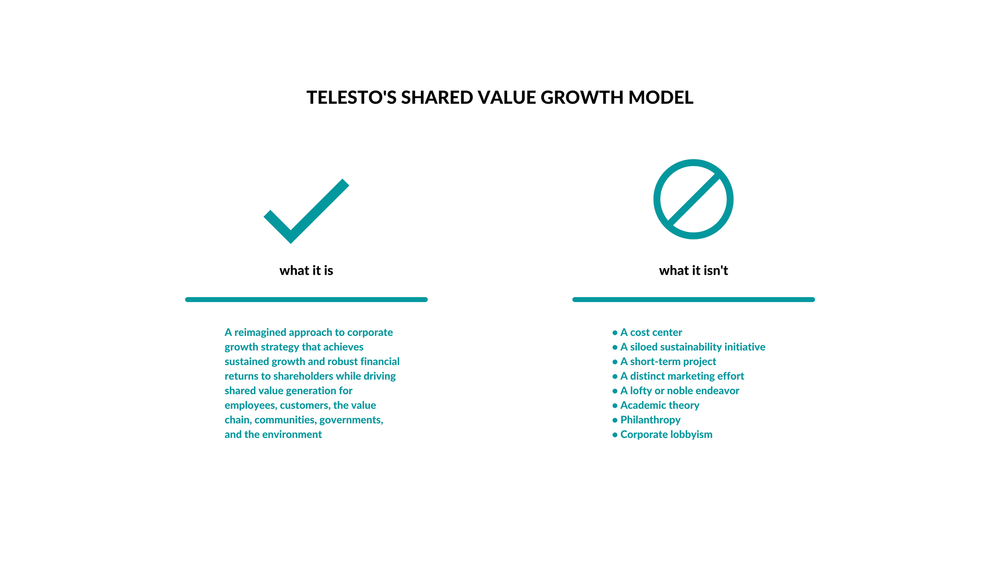

With that foundation, we have designed a shared-value model for growth. One where corporations redefine their purpose, values, and goals and broaden their thinking beyond shareholder value, short-termism, and extraction. This pivot allows for new business opportunity through partnerships, opens new markets, leads to new product development, improves customer loyalty, and enhances overall brand value. This pivot also ensures the resilience and agility of their supply chain and business ecosystem. At the most macro level, this approach ensures the sustainability and long-term health of all global populations and living beings.

When we assess definitions of value, a natural point of commencement is with shareholders and profitability. This has been the predominant theme of corporate success over the past three decades. What are annual profits? What is our revenue growth? What is our stock price?

These have been the hallmark of corporate decision-making for some time, and it has served many companies well in their ability to grow, amass wealth, and attract the best talent. However, as mentioned earlier, we know that businesses understand there is more value to be gained in expanding their thinking beyond shareholders.

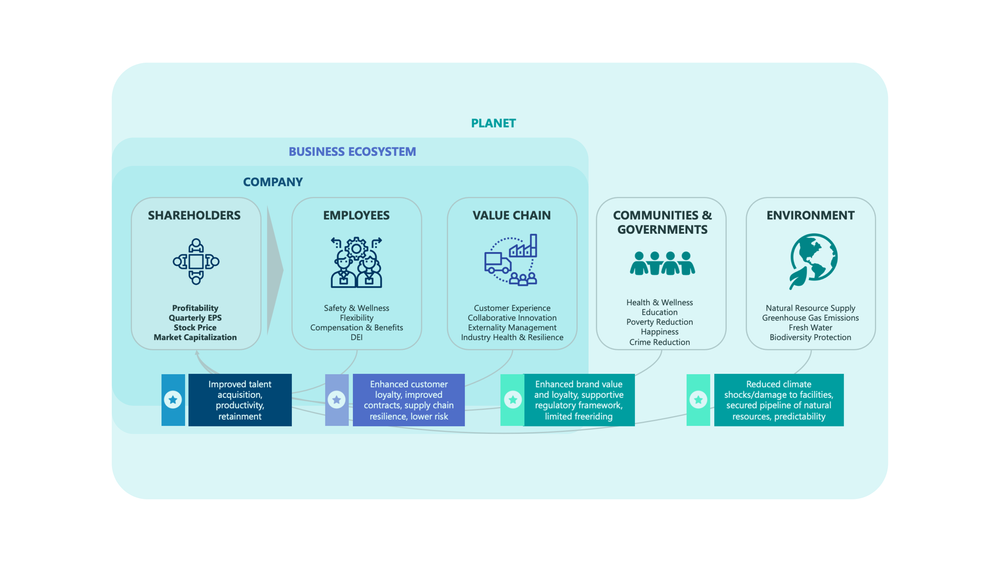

Alongside shareholder value, within the same walls of an organization, we can just shift out enough to explore and assess employee-value generation. This is the adjacent corporate purpose and value driver that would come as companies begin this process of zooming out. When companies factor in shared value with employees across all phases of strategy design and implementation, great yields will be had in overall employee engagement, retainment, happiness, loyalty, and attraction of the world’s best talent. This, in turn, creates positive feedback loops back to shareholders of improved profitability, stock price, market capitalization, etc.

The next expansion of the concentric value circles is to explore opportunities in the value chain for shared growth. This is a progression that many find impossible, counterintuitive, or counterproductive to consider seriously for opportunities of shared growth. Some might worry, why would I want to share growth or add value to potential competitors? “Why would I cooperate? Isn’t the point of business to compete?” All valid questions. The shared value model does advocate and uphold competitive strategies, yet it leverages the systems thinking and embeds the constraints of our new economy by advocating for competition within a collaborative framework. By expanding the sphere of growth, shareholders can expect great predictability in planning, improved supply-chain resilience, more engaged and loyal customers, and less waste in production and transport.

As we continue to build feedback loops of value, a commonly missed opportunity is to direct these efforts to both communities and governments. Communities surround the millions of companies that exist around the world and yet are rarely included in decision-making nor as a viable stakeholder. At best, marginalized communities are targeted for certain “bottom of the pyramid” CPG products. Regarding government engagement, it is well understood that there are significant company profits up for grabs depending on the regulatory context. If companies think longer-term and more holistically, they see that by engaging with governments within a collaborative framework, new partnership can form with even the most competitive market forces. Under these mechanisms, companies and governments can come together to pool resources for R&D, standards development, proactive legislative development, and information exchange. Additionally, these councils and forums can establish mechanisms to identify and eliminate free-riding by punishing those who attempt to cheat the system and work outside its framework.

The final frame of the shared value model is to consider the environment as a critical value driver. To date, this has been categorized as sustainability or net-zero target emissions. Yet, there is so much more. When companies look to the environment not in a just a drawdown and extractive lens, but consider regeneration of natural resources as critical to their supply-chain resilience and overall business vitality, then businesses can start to engage in a truly sustainable, regenerative manner. Shareholders will benefit from reduced climate shocks and thus less damage to facilities and operations. Shareholders will secure and enhance long-term pipelines of natural resources and enjoy the predictability associated with a more symbiotic relationship with the environment.

A starting point in making this transition is in a deep and honest reflection of your present maturity. Where does your company stand in its approach to value and corporate purpose? What is your focus? What does success look like? We’ve identified five steps in the progression toward shared value.

Achieving shared value is a long-term, continuous journey, and we understand that organizations will be in different stages of maturity. We also understand that organizations have different degrees of ambition as it relates to the principles of shared value. Therefore, we’ve designed a laddered maturity model to serve as a tool for organizations to understand where they have opportunities to explore, where they have risks to mitigate, and how they stack up against other organizations and industries.

Unaware

Leadership is operating with a limited focus on short-term profitability and is thus unable to see opportunities in shared value, new business models, and addressing global challenges.

Introspective

Organization sees the need for a new approach given lagging performance and negative reputation and has established a small budget with preliminary planning underway.

Interactive

Plans to achieve shared value have been developed and adopted, and pilot programs have been successful. Efforts are being supported in budget. Its growth model is less extractive but only spurs growth for the company, ignoring value-chain opportunities.

Circular

Shared-value transformational program is in place and growing throughout the organization with success. Sufficient budget available. Growth model considers value for people, profit, and planet model.

Shared value

Shared-value transformation is now a core aspect of the organization’s vision strategy, culture, processes, and positive ROI delivery. Its growth model is mutualistic, one where many stakeholders share in the value generated.

The most challenging component of inclusive growth is how to know when you are actually achieving it; although still challenging, considerable progress has been made over the past 30 years, and there is more convergence than ever on quantifiable approaches.

We see countless international and non-profit organizations working toward a common set of metrics and variables to enhance reporting and disclosure. However, at this point, there is still so much that is changing and not universally accepted. Therefore, we have used these tools as a foundation to build a set of criteria and parameters to inform the classification of an organization’s maturity on its way to achieving shared value. These criteria have been outlined for each of the shared value model’s value dimensions: shareholders, employees, value chain, communities and government, and the environment.

Although leaders understand that the shift to a low-carbon future is essential and climate leadership is no longer a “nice-to-do,” the complexity of navigating how to move along this journey of shared value is complex, changing, and big. Moreover, in light of the new presidential administration, business leaders will be expected to do more to demonstrate purpose and values as core to a company’s growth strategy.

To simplify this complex and fast-evolving context, we’ve established a progression of initiatives and activities to simplify this journey for executive leadership.

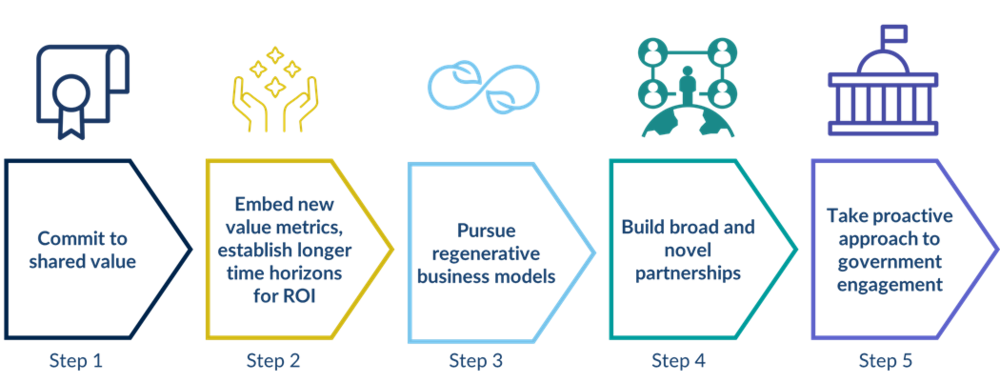

Step 1 commit to shared value

This journey starts with initiatives set out by the highest level of leadership.

Step 2 embed new value metrics, establish longer time horizons for ROI

Metrics matter. Broadening metrics to include stakeholders and the environment in calculating value is essential. This process is complex, and we’ve simplified this for leaders to adopt the metrics that matter to their vision and mission.

Step 3 pursue regenerative business models

The constraints of our new economy require new business models, ones that are circular and regenerative. This step is designed to help companies evaluate opportunities and plan for piloting of their best options before larger-scale roll-out.

Step 4 build broad and novel partnerships

The challenges that the world faces can’t be dealt with by any single company or country, and without taking on these challenges, businesses face an existential risk. Finding new, cooperative ways of working together will allow leading businesses to prosper.

Step 5 take proactive approach to government engagement

Government engagement will also have to evolve in the new economy through mechanisms such as collaborative standards and regulatory development, fundamental research, resilience design, and community planning and development

For leaders who have the courage to think in the long term, there is so much that they can start doing today to realize the promise of purpose and to adopt a shared value model of growth. For more information on how this approach works and how it can be applied to your organization, don’t hesitate to reach out to our team (alex.kruzel@telestostrategy.com).

Inside Climate Change, “BP and Shell Write-Off Billions in Assets, Citing COVID-19 and Climate Change”

World Economic Forum, “Toward Common Metrics and Consistent Reporting of Sustainable Value Creation”